On January 17, 2026, the Government of Vietnam promulgated Decree No. 24/2026/ND-CP, regulating the list of chemicals subject to the scope of the Law on Chemicals 2025. Among them, the List of Specially Controlled Chemicals (Appendix III) is the group that has the most direct and significant impact on enterprises’ chemical import activities.

Failure to fully understand and comply with the new regulations may result in cargo congestion at ports, administrative penalties, or even forced re-export.

This article provides the most comprehensive and up-to-date guidance on procedures for importing specially controlled chemicals under Decree No. 24/2026/ND-CP.

1. What Are Specially Controlled Chemicals?

According to Article 3 of Decree No. 24/2026/ND-CP, specially controlled chemicals are those listed in Appendix III, including:

-

Chemicals posing high risks to safety, security, and the environment

-

Chemicals related to precursors and international conventions

-

Chemicals with a high potential for misuse or causing serious incidents

In addition to single chemicals, chemical mixtures are also considered specially controlled chemicals if they:

-

Contain components listed in the Special Control List exceeding the regulated concentration threshold

-

Simultaneously contain chemicals classified under the list of chemicals subject to conditional production and trading

2. Which Enterprises Are Required to Obtain Import Licenses?

Enterprises are required to comply with specialized management procedures if they:

-

Import chemicals listed in Appendix III of Decree No. 24/2026/ND-CP

-

Import chemicals for manufacturing, trading, processing, research, or industrial use

-

Import single chemicals or mixtures exceeding the regulated control thresholds

Competent authority:

Ministry of Industry and Trade (MOIT) – Vietnam Chemicals Agency

3. Dossier for Importing Specially Controlled Chemicals

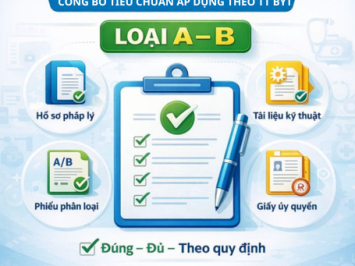

Depending on the type of chemical, enterprises may be required to prepare all or part of the following documents:

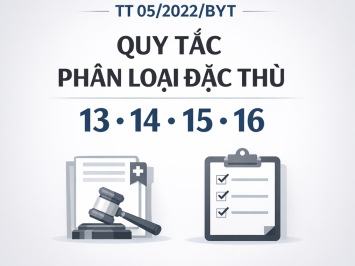

3.1. Legal and Licensing Documents

For enterprises importing for production or trading purposes:

-

License for chemical production or trading (Article 13, Decree No. 26/2026/ND-CP)

-

Chemical import license (Article 14, Decree No. 26/2026/ND-CP)

For enterprises importing for internal use:

-

Declaration of chemical use (Article 15, Decree No. 26/2026/ND-CP)

-

Chemical import license (Article 14, Decree No. 26/2026/ND-CP)

Exemption cases are clearly stipulated in Article 21 of Decree No. 26/2026/ND-CP.

3.2. Technical Documents

-

Sales Contract

-

Commercial Invoice

-

Packing List

-

Bill of Lading / Airway Bill

-

Safety Data Sheet (SDS) in accordance with GHS standards

-

Technical specifications, chemical composition, and concentration details

3.3. Customs Documents

-

Import customs declaration

-

Appropriate HS code based on the chemical nature

-

Specialized inspection documents as required by the Ministry of Industry and Trade

4. Procedures for Importing Specially Controlled Chemicals

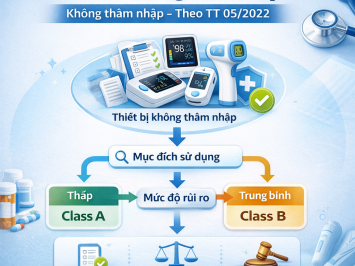

Step 1: Identify the chemical classification

→ Cross-check chemical name, CAS number, and concentration against Appendix III of Decree No. 24/2026

Step 2: Apply for the required license (if applicable)

→ Submit the dossier to the Vietnam Chemicals Agency – Ministry of Industry and Trade

Step 3: Carry out customs clearance procedures

→ Submit electronic customs declarations together with valid licenses and certificates

Step 4: Customs clearance and record retention

→ Enterprises must retain chemical dossiers and maintain records of import, use, and storage in accordance with regulations

5. Important Notes for Importing Enterprises

-

Not all chemicals can be freely imported as before 2026

-

ISO certifications or internal safety systems do not replace statutory legal licenses

-

Incorrect declaration of HS codes or chemical composition may result in severe penalties

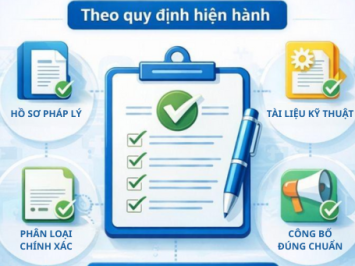

6. Solutions for Enterprises

In the context of stricter control under the Law on Chemicals 2025 and Decree No. 24/2026/ND-CP, enterprises should:

-

Review their entire portfolio of imported chemicals

-

Standardize legal and technical documentation from the outset

-

Cooperate with professional logistics and legal consulting partners to mitigate compliance risks

Songwin International Logistics

Your trusted partner in chemical import compliance, providing:

-

Chemical classification consulting and control list determination

-

Support in obtaining chemical licenses under the latest regulations

-

End-to-end customs clearance and logistics services

Strong legal knowledge – Accurate customs clearance – An uninterrupted supply chain

![🔥 [BREAKING NEWS] Decree 46/2026/ND-CP Officially “Terminates” the Self-Declaration Mechanism – A New Era of Food Safety Management](https://songwinlog.net/thumbs/355x266x1/upload/news/them-tieu-de-phu-9121.png)