A complete A–Z guide on chemical import procedures in accordance with Decree 113/2017/NĐ-CP and Decree 82/2022/NĐ-CP. Learn about classification, chemical declaration (VNSW), and fast customs clearance solutions.

Importing chemicals is one of the most complex customs operations, requiring businesses to strictly comply with multiple legal regulations. Even a minor mistake in classification, documentation, or declaration can lead to shipment delays, costly storage fees, or administrative penalties.

Figure 1. Chemical import handled by Songwin Logistics

Figure 1. Chemical import handled by Songwin Logistics

This article provides a comprehensive overview of the chemical import process in Vietnam and introduces reliable logistics solutions to help your business achieve “super-fast” customs clearance.

1. Why Are Chemical Import Procedures So Complex?

Unlike ordinary goods, chemicals are conditional goods—subject to management by multiple ministries, primarily the Ministry of Industry and Trade (MOIT). The key legal documents governing chemical imports include:

-

Law on Chemicals No. 06/2007/QH12

-

Decree 113/2017/NĐ-CP: Detailed regulations on the implementation of the Law on Chemicals

-

Decree 82/2022/NĐ-CP: Amendments and supplements to Decree 113

-

Circular 32/2017/TT-BCT: Implementation guidelines

The complexity lies in the fact that each type of chemical—depending on its composition and intended use—belongs to a different management category, resulting in distinct import procedures.

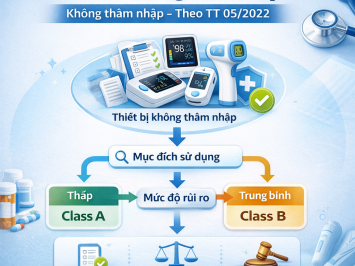

2. Chemical Classification

Before placing any orders, it’s crucial to determine which category your chemical falls under (based on the Annexes of Decree 113/2017/NĐ-CP and Decree 82/2022/NĐ-CP):

Chemicals Requiring Declaration (Annex V)

-

The most common case, applicable to most industrial chemicals.

-

Businesses must submit an online chemical declaration via the National Single Window (VNSW) before the shipment arrives at the port.

Chemicals Requiring Import License (Annex II)

-

These are restricted chemicals.

-

Businesses must obtain an Import License from the Vietnam Chemicals Agency (Ministry of Industry and Trade) before signing contracts and importing goods.

-

This procedure is more complicated and time-consuming.

Precursors

-

Industrial precursors (Annex I & II), narcotic precursors (under the Ministry of Public Security), and pharmaceutical precursors (under the Ministry of Health) are strictly controlled and require specialized import licenses.

Prohibited Chemicals (Annex I)

-

Absolutely prohibited from importation.

Exempted Chemicals

-

Such as chemicals imported in quantities under 10kg/lot (non-commercial), or for scientific research, defense, or security purposes.

Note: Misidentifying CAS numbers or chemical names—leading to incorrect procedure application—is among the most common and costly errors businesses face.

3. Import Procedures

For chemicals requiring declaration (Annex V), the standard import process includes:

Step 1: Prepare Documents

Mandatory documents include, most importantly, the Material Safety Data Sheet (MSDS):

-

Material Safety Data Sheet (MSDS) – Original English version and Vietnamese translation required

-

Sales Contract

-

Commercial Invoice

-

Bill of Lading / Air Waybill

-

Certificate of Origin (C/O) – if applicable

Step 2: Chemical Declaration via National Single Window (VNSW)

-

The importer uses a digital signature to log in at https://vnsw.gov.vn.

-

Create a declaration dossier and upload the required documents from Step 1.

-

Submit the dossier and wait for review by the Vietnam Chemicals Agency (MOIT).

Result: If valid, the system issues an Electronic Certificate of Chemical Declaration — a prerequisite for customs clearance.

Step 3: Customs Declaration

-

Once the declaration certificate is obtained, proceed with customs declaration using customs software.

-

Attach shipment documents and the approved declaration certificate number from Step 2.

-

Transmit the customs declaration and await the inspection result (Green, Yellow, or Red channel).

Step 4: Customs Clearance & Cargo Release

-

Green Line: Exempt from inspection; clearance granted after tax payment.

-

Yellow Line: Customs reviews the full set of documents.

-

Red Line: Customs conducts physical inspection (checking labeling, quantity, and consistency with MSDS).

4. Songwin International Logistics Vietnam – Fast & Reliable Chemical Import Solutions

Do you find the above procedures overwhelming and risky?

-

Unsure which Annex your chemical belongs to?

-

No time to monitor the VNSW declaration process?

-

Worried about labeling compliance under Decree 43/2017/NĐ-CP?

-

Concerned about costly storage fees due to rejected applications?

Let Songwin International Logistics Vietnam handle it for you.

We provide comprehensive customs and chemical import services that help you focus on your core business while we ensure smooth clearance.

Why Choose Us?

✅ Deep Expertise: Our specialists thoroughly understand Decree 113, Decree 82, and all related regulations — ensuring accurate classification and compliance.

✅ Speed & Precision: We accurately identify HS and CAS codes, submit VNSW declarations promptly, and closely monitor progress to ensure the fastest approval.

✅ All-in-One Service:

-

Free consultation on documentation and labeling (MSDS, labeling requirements)

-

VNSW declaration on behalf of clients

-

Import license application for restricted chemicals (Annex II)

-

Customs declaration and clearance at ports/airports

-

Support for quality inspection or customs examination (if required)

-

Door-to-door delivery

✅ Cost Optimization: Our standardized process minimizes errors, accelerates clearance, and reduces storage and demurrage costs.

Songwin’s Commitment:

✅ 100% Legal Compliance

✅ Client Information Confidentiality

✅ Competitive Pricing

📞 CONTACT US NOW FOR FREE CONSULTATION

Don’t let paperwork delay your business.

One phone call could save you millions in warehouse and storage fees!

Songwin International Logistics Vietnam

📍 Address: 344 Nguyen Trong Tuyen Street, Tan Son Hoa Ward, HCMC

📞 Hotline (Zalo): 083.681.3969 - 0373.262.105

✉️ Email: sales2@songwinlog.com

![🔥 [BREAKING NEWS] Decree 46/2026/ND-CP Officially “Terminates” the Self-Declaration Mechanism – A New Era of Food Safety Management](https://songwinlog.net/thumbs/355x266x1/upload/news/them-tieu-de-phu-9121.png)