The demand for plastic food containers (such as lunch boxes, storage boxes, and trays) in Vietnam has been growing rapidly. Consequently, many businesses are seeking to import these products for commercial purposes.

However, since plastic food containers come into direct contact with food, they fall under the specialized management of the Ministry of Health. Therefore, the import process is more complex than that of ordinary goods — enterprises must complete the Self-Declaration of Product Compliance before customs clearance.

.png)

This article provides an A–Z guide on how to import plastic food containers smoothly and in compliance with Vietnamese regulations.

1. Legal Framework

The importation of plastic food containers is governed by the following legal documents:

-

Law on Food Safety No. 55/2010/QH12 – General regulations on food safety.

-

Decree No. 15/2018/NĐ-CP – Implementation guidelines for several articles of the Law on Food Safety. This is the most critical regulation on Self-Declaration of Product Compliance.

-

Circular No. 38/2015/TT-BTC, amended by Circular No. 39/2018/TT-BTC – Customs procedures, inspection, and supervision.

-

Decree No. 43/2017/NĐ-CP, amended by Decree No. 111/2021/NĐ-CP – Labeling requirements for goods.

According to these regulations, plastic food containers (utensils, packaging, and food-contact materials) are not prohibited from import, but importers must complete the Self-Declaration procedure before importation.

2. HS Code & Import Tax Policy

Identifying the correct HS Code is crucial to determining applicable taxes and customs procedures.

Plastic food containers are typically classified under Chapter 39 – Plastics and Articles Thereof, specifically:

-

Heading 3924 – Tableware, kitchenware, household articles, and sanitary ware, of plastics.

-

3924.10 – Tableware and kitchenware

-

3924.10.90 – Other (commonly used for plastic containers and trays for food storage).

-

Note: The HS code above is for reference only. The final classification depends on the product’s material, design, and actual function. For accurate classification, contact Songwin Logistics for HS code consulting.

Import tax policies:

-

VAT: Applicable according to current regulations.

-

MFN import duty: Varies depending on classification.

-

Preferential (FTA) import duty: 0–5% if the shipment includes a valid Certificate of Origin (C/O) under an FTA signed with Vietnam:

-

Form E – ACFTA (China)

-

Form D – ATIGA (ASEAN)

-

Form AK – AKFTA (Korea)

-

Form EVFTA – EU

-

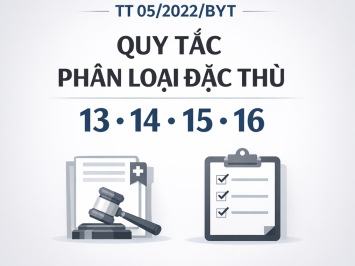

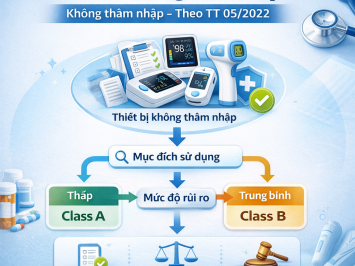

3. Key Procedure: Self-Declaration of Product Compliance

This step must be completed before the goods arrive at the port or before customs declaration.

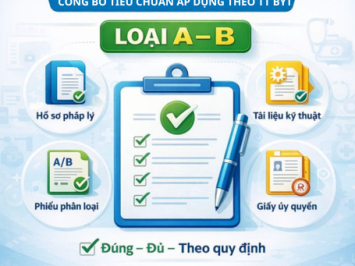

a. Required Documents:

-

Self-Declaration Form: According to Form No. 01, Appendix I of Decree 15/2018/NĐ-CP.

-

Test Report (Product Analysis Report):

-

Original or notarized copy.

-

Must be valid within 12 months of submission.

-

Issued by a designated or accredited laboratory (ISO 17025 standard).

-

Must include all safety indicators required under applicable National Technical Regulations (QCVN) by the Ministry of Health.

-

b. Procedure:

-

Step 1: Prepare the complete dossier.

-

Step 2: Submit the dossier:

-

Upload the Self-Declaration dossier to the Vietnam Food Administration (Ministry of Health) portal or the local Food Safety Management Authority (online public service system).

-

Submit one hard copy (or electronic file) to the competent authority (Department of Health or Food Safety Management Board).

-

-

Step 3: Acknowledgment:

-

Once the declaration is submitted, the enterprise is legally permitted to manufacture, distribute, and import the product.

-

The competent authority will record and publish the Self-Declaration on their official website (used for customs verification).

-

-

Step 4: Completion:

-

The enterprise obtains a Receipt of Self-Declaration (often bearing an official registration number), which is then provided to customs during import procedures.

-

Note: The enterprise is fully responsible for the accuracy of its dossier and the product’s safety.

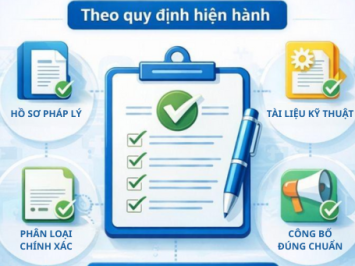

4. Customs Clearance Procedures

After obtaining the Self-Declaration Receipt, the importer can proceed with customs clearance as for normal goods.

a. Required Customs Documents:

-

Customs declaration form

-

Commercial invoice

-

Bill of Lading / Airway Bill

-

Packing list

-

Certificate of Origin (C/O)

-

Receipt of Self-Declaration registration

-

Test Report

b. Customs Process:

-

Step 1: Submit the e-customs declaration; the system will assign a channel (Green, Yellow, or Red).

-

Step 2: Submit supporting documents (electronically or in person) to the customs office.

-

Step 3:

-

Green channel: Automatic clearance; importer pays taxes and receives goods.

-

Yellow channel: Customs reviews the dossier; if valid, clearance is granted.

-

Red channel: Customs inspects the dossier and conducts a physical inspection of the shipment.

-

-

Step 4: Once cleared, the importer pays duties and proceeds to pick up the goods.

5. Labeling Requirements

Imported goods must comply with Decree 43/2017/NĐ-CP and Decree 111/2021/NĐ-CP on product labeling.

A Vietnamese sub-label is mandatory for plastic food containers, including:

-

Product name (e.g., Plastic Food Container).

-

Name and address of the importer (responsible entity in Vietnam).

-

Name and address of the manufacturer.

-

Country of origin (e.g., Made in China).

-

Quantity or capacity (e.g., size, volume).

-

Material composition (e.g., PP plastic, PET plastic).

-

Safety information and warnings (e.g., Food-safe, Heat resistant from -10°C to 100°C, Microwave safe).

-

Instructions for use and storage.

Conclusion

The most crucial steps in importing plastic food containers are Self-Declaration and Product Testing. Enterprises should complete these processes before shipment arrival to avoid costly storage and demurrage at the port.

This process requires an in-depth understanding of food safety regulations and experience working with regulatory authorities.

Need Help Importing Plastic Food Containers?

With extensive experience handling products regulated by the Ministry of Health,

Songwin International Logistics Vietnam offers a comprehensive import service, including:

-

Accurate HS code and tax consultation.

-

Product testing coordination.

-

Drafting and submission of Self-Declaration dossiers.

-

Complete customs clearance procedures.

📍 Address: 344 Nguyễn Trọng Tuyển, Tân Sơn Hòa Ward, Ho Chi Minh City

📞 Hotline (Zalo): 083.681.3969 - 0373.262.105

📧 Email: Sale2@songwinlog.com

![🔥 [BREAKING NEWS] Decree 46/2026/ND-CP Officially “Terminates” the Self-Declaration Mechanism – A New Era of Food Safety Management](https://songwinlog.net/thumbs/355x266x1/upload/news/them-tieu-de-phu-9121.png)