To cope with the impact of U.S. countervailing tariffs, businesses can shift from exporting raw products to deeply processed goods.

Containers being handled at a U.S. port. Photo: New York Times.

Speaking at the seminar “Current Situation and Challenges in Exporting to the U.S.” held within the launch event of the Vietnam–U.S. international B2B e-commerce platform (VietnamUSA.Arobid.com) on August 8, Mr. Vu Ba Phu, Director General of the Vietnam Trade Promotion Agency, noted that the issue of the U.S. imposing tariffs on goods from various countries is nothing new.

Exports Risk Slowing Down

In recent years, the U.S. has become Vietnam’s second-largest trading partner. “Moreover, the U.S. is an important partner because of the broad range of goods it imports. We can export items from US$1 garments to products worth hundreds of dollars. Regardless of the tariff level, we still need to export to the U.S., but we must find the most advantageous way,” Mr. Phu said.

At present, if businesses cannot export to the U.S., it is also difficult for them to immediately divert goods to other markets.

According to Mr. Phu, annual export turnover between Vietnam and the U.S. has grown by about 12–14%, with the first seven months of this year seeing growth of about 15%.

Notably, in the first half of the year, total export turnover to the U.S. reached nearly US$71 billion, up about 29% compared to the same period in 2024, as U.S. companies ramped up imports ahead of tariff concerns.

“Vietnamese exports to the U.S. have surged, leading to large inventories. We must anticipate that in the next six months—or even into the first half of 2026—exports of wood products, textiles, and garments to the U.S. will slow down,” Mr. Phu observed.

The U.S.’s recent imposition of a 20% countervailing tariff starting August 1 will further pressure export costs. Therefore, the question is how to optimize benefits and reduce risks.

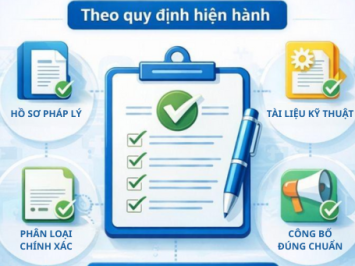

From these challenges, Mr. Phu recommended that businesses must clearly and transparently demonstrate the origin of goods before exporting to the U.S.

In addition, enterprises should not only export raw products but also focus on goods with higher levels of processing to increase value.

Textile & Garment Industry Impact

As a player in the textile and garment industry, Mr. Tran Nhu Tung, Chairman of the Board of Directors of Thanh Cong Textile Garment – Investment – Trading JSC (TCM), said that in Q1, before the U.S. officially imposed a 46% countervailing tariff on Vietnamese textiles, the market still showed positive signs.

In the first six months of the year, Vietnam’s global textile and garment exports reached about US$21.8 billion, up 13% year-on-year, with exports to the U.S. alone at about US$17.5 billion, up 17%.

Many partners increased their orders before the tariff took effect, contributing to strong growth in the first half. However, in Q3, orders have shown signs of “losing steam” due to high inventory and customers pausing new purchases while waiting for clearer tax information.

Mr. Tung expects that once the official tariff rates are established, the U.S. market will stabilize and orders will return to normal in Q4. This could support the textile industry’s 2025 export target of US$48 billion, representing about 10% growth.

Need for Digital Transformation & Product Traceability

Industry representatives also noted that new requirements—such as green-certified factories, traceability, and international certifications—are driving up investment costs, while sale prices remain unchanged.

In addition to competing with countries with low labor costs such as Bangladesh, India, and Indonesia, Vietnam’s biggest rival in textiles is still China—with its full advantages in scale, integrated supply chains, and superior production capacity.

Mr. Tung pointed out that Vietnam’s textile industry still relies heavily on imported materials from China. Businesses must understand how tariffs are calculated when using imported materials versus domestic production.

For example, if cotton is purchased from the U.S., spun into yarn, woven into fabric, sewn, and exported from Vietnam, the tariff rate will differ from importing fabric directly from China. As regulations become clearer, this will be an opportunity to boost domestic material production and reduce import dependency.

Notably, the U.S. may require detailed declarations of the material percentage from each country in exported products. This means businesses must implement ERP systems to ensure accurate traceability. Without proof of origin, goods may be subject to the highest tariff rates, causing significant losses.

Mr. Tung stressed that textile companies must proactively prepare both in management technology and raw material strategies to meet strict standards while maintaining profit margins in an increasingly competitive environment.

“There must be support for digital transformation and green transition. For large enterprises, investing US$1–2 million in ERP is normal, not to mention additional spending on renewable energy and emission reductions. These are significant costs, so if there is financial support at low interest rates, businesses will be more confident in investing,” Mr. Tung added.

Support from Trade Promotion Agency

Given these challenges, Mr. Phu said that as the national trade promotion agency, they will always accompany and support businesses, connecting innovative platforms such as VietnamUSA.Arobid.com with the export-support ecosystem—from national trade promotion programs to Vietnam’s trade offices in the U.S. and key markets.

In the context of global trade fluctuations—with rising technical barriers, traceability requirements, ESG standardization, and especially new tax policies—finding new, more transparent and efficient trade models that are less dependent on traditional distribution chains is becoming essential for Vietnamese businesses, especially SMEs.

The launch of the Vietnam–U.S. international B2B e-commerce platform is not only a technical solution but also a strategic move that demonstrates Vietnamese businesses’ proactive vision in the new global context.

This platform will be a deep digital trade ecosystem, helping Vietnamese businesses not only sell products but also upgrade capabilities, standardize compliance, access capital, and expand supply chains sustainably.

Mr. Tran Van Chin, Chairman of Arobid Technology JSC, affirmed that Vietnamese businesses do not lack good products but lack a standardized support ecosystem to step into the global market.

Therefore, VietnamUSA.Arobid.com will help businesses overcome three core barriers—digitalization, capital, and ESG—which are essential for sustainable exports to the U.S.

![🔥 [BREAKING NEWS] Decree 46/2026/ND-CP Officially “Terminates” the Self-Declaration Mechanism – A New Era of Food Safety Management](https://songwinlog.net/thumbs/355x266x1/upload/news/them-tieu-de-phu-9121.png)